Investors tend to see short-term volatility as the enemy. Volatility may lead many investors to move money out of the market and “sit on the sidelines” until things “calm down.” Although this approach may appear to solve one problem, it creates several others:

- When do you get back in? You must make two correct decisions back-to-back; when to get out and when to get back in.

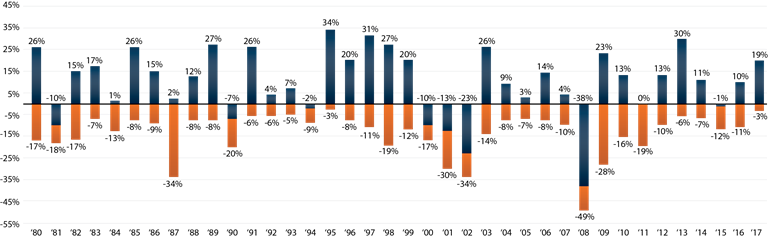

- By going to the sidelines you may be missing a potential rebound. This is not historically unprecedented; see chart below.

- By going to the sidelines you could be not only missing a potential rebound, but all the potential growth on that money going forward.

We believe the wiser course of action is to review your plan with your advisor and from there, decide if any action is indeed necessary. This placates the natural desire to “do something”, but helps keep emotions in check.

Volatility is not a recent phenomenon. Each year, one can expect the market to experience a significant correction, which for the S&P 500 has averaged approximately 14% since 1980. Although past performance is no guarantee of future results, history has shown that those who chose to stay the course were rewarded for their patience more often than not.

Source: First Trust Advisors L.P., Bloomberg. The benchmark used for the above chart is the S&P 500 Index. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Returns are based on price only and do not include dividends. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. Past performance is no guarantee of future results.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA and the Internal Revenue Code. First Trust has no knowledge of and has not been provided any information regarding any investor. Financial advisors must determine whether particular investments are appropriate for their clients. First Trust believes the financial advisor is a fiduciary, is capable of evaluating investment risks independently and is responsible for exercising independent judgment with respect to its retirement plan clients.

Not FDIC Insured • Not Bank Guaranteed • May Lose Value