By Joe Elsasser, CFP® Financial Planner, Software Creator

Many advisors venture into the Social Security planning world after interfacing with an article or a calculator that identifies the value difference between claiming early and some optimized strategy that includes the delay of at least one member of the couple’s benefit. The value difference can be striking, often from tens to hundreds of thousands of dollars.1

While the value difference in cumulative or present-value of benefits is significant, advisors who incorporate these strategies into their clients’ overall financial plans can often find additional value in the form of income tax savings. The combined effect of tax reduction and higher cumulative Social Security benefits reduces the drawdown on the client’s savings, thereby extending the life of the investment portfolio. Additionally, because Social Security was designed as Social Insurance, common retirement risks may be mitigated.

In this paper, we analyze a hypothetical couple’s results using the Nationwide Social Security 360 AnalyzerSM. We compare the differences in claiming Social Security Benefits as early as possible to an optimized strategy. The results are examined in the context of their overall retirement planning, identifying the difference in projected taxes under each of the Social Security strategies in order to determine the combined impact of additional Social Security benefits and tax savings on the life of the portfolio.

Finally, the adaptability of a given strategy to a changing set of circumstances is important, so we “Stress Test” the Social Security Strategy in light of three common risks faced by today’s retirees:

- Poor market returns early in retirement (Sequence of Returns Risk)

- Early death of either member of the couple

- High health care expenses late in retirement

This process is quite similar to that followed by many advisors when creating a client’s financial plan. The intent of this paper is not to say that every Social Security Strategy will deliver the same value or the same specific benefits, but instead to identify the multiple benefits that Social Security strategies may provide and illustrate a process by which many advisors demonstrate those benefits to a client.

The Couple

John and Jane Sample have had relatively high wages throughout their lives and retired at the end of last year. Their most recent Social Security statements provide that John and Jane’s Primary Insurance Amounts (PIA) are $2,500 and $1,800, respectively. John was born in December of 1950, so as of the date of this case study, he is 64.2 Jane was born in December of 1952, so she is 62. Both John and Jane are in good health, so we’ll assume an age of death of 85 for John and 90 for Jane.3

Pertinent Information for Social Security planning

| John | Jane | ||

| Age | 64 | 62 | |

| PIA | $2,500 | $1,800 | |

| Health | good | good | |

| Life Expectancy | age 85 | age 90 | |

Social Security Benefit Optimization

These examples are hypothetical in nature and are not intended to be used as investment advice. Individual situations may vary.

A couple in John and Jane’s situation has many options for their Social Security claiming strategy. They could do what most people do: claim benefits as early as possible.4 Or, they could choose from thousands of possible claiming dates and use claiming techniques such as a voluntary suspension or a restricted application. Significant research has shown that individuals and married couples, in particular, can realize substantial additional value from Social Security through optimization.5 Because the optimization process should minimally evaluate hundreds of options, many advisors use software to assist in the process. These software programs generally identify a large number of possible claiming ages, plot out the projected cash flows under each strategy and perform some variation of a time value of money calculation to ensure a fair comparison of cash flows that occur over different time periods. The highest present-value of cash flows and claiming instructions are then returned to the user as an optimized claiming strategy.

In John and Jane’s case, we compare two primary strategies. The Early Strategy is the earliest that is actually available to our client couple, keeping in mind that he is currently 64 and she is 62. The Social Security 360 Analyzer gives us a present value of $769,198. The Suggested Strategy, representing the highest present-value of cash flows among the strategies tested is $854,835. The present value difference between the two strategies is approximately $85,000. Details on these figures can be found in the Social Security 360 Analyzer tool report which is located in the appendix.

When John and Jane visited their advisor, they expected to claim Social Security benefits immediately upon retirement, anticipating that decision would allow them to take a smaller withdrawal from their IRA accounts.

After completing the analysis in the Social Security 360 Analyzer, the advisor suggested a considerably different Social Security claiming approach. Rather than taking benefits immediately upon retirement, Jane should delay until age 64 and John should elect only spousal benefits at his Full Retirement Age of 66, switching to his own benefit at age 70.

Comparison of Cash flows6

Early

| Type of Benefit | Start Age | Monthly Amount | Stop Age |

| John’s Retirement | 64 and 1 Month7 | $2,180 | Death (85) |

| Jane’s Retirement | 62 and 1 Month | $1,357 | John’s Death (83) |

| Jane’s Widow Benefit from John | 83 | $3,935 | Death (90) |

Suggested

| Type of Benefit | Start Age | Monthly Amount | Stop Age |

| John’s Spousal | 66 | $926 | 70 |

| John’s Retirement | 70 | $3,824 | Death (85) |

| Jane’s Retirement | 64 | $1,606 | John’s Death (83) |

| Jane’s Widow Benefit from John | 83 | $5,957 | Death (90) |

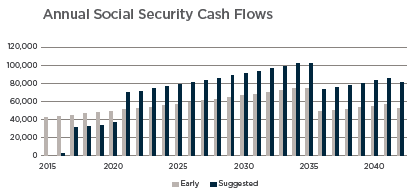

When shown graphically, the difference between the two cash flow patterns is apparent. The Early cash flow begins immediately and steadily rises due to cost of living adjustments through the course of the couples’ retirement. In 2035, upon John’s death the cash flow declines as his benefit continues to be paid to Jane as a Survivor benefit and her smaller benefit stops. In the Suggested Strategy cash flow pattern, there is no cash flow in the first year, then a period of four years with relatively small cash flows, and a significant jump at John’s age 70 in 2020. Upon John’s death in 2035, his larger retirement benefit continues to Jane as a survivor benefit.

Because the couple has other assets that can be used to fund the early years of their retirement, following the Suggested Strategy in order to capture the extra $85,000 in Social Security value should be a relatively easy decision.

Mortality Considerations

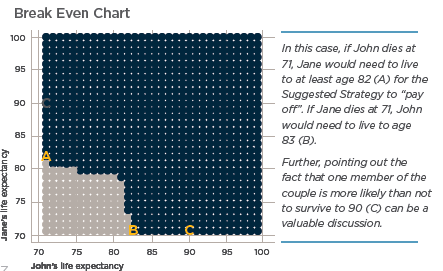

The decision to delay or postpone claiming Social Security benefits looks good on paper, but client resistance to the idea is common. Conversations with clients often drift to concerns about longevity — more specifically, doubts about longevity. Intuitively, the client knows that delaying benefits will mean fewer checks are received. If the client dies before “catching up” with the missed checks, they feel they will have come up short. There are two common ways advisors handle these concerns— first with a break-even analysis, which considers the Social Security Strategy in a vacuum separately from the clients’ other assets, and second by stress testing the overall plan with the recommended Social Security Strategy.

While longevity statistics are relatively clear, advisors occasionally face a difficult role in discussing the potential for longevity with their clients. Without reference to the specific health history of a client, males reaching age 65 have a 50% chance of living past age 83 and women who reach age 65 have a 50% chance of living to 86. However, even more important to the development of a Social Security Strategy for a couple is the fact that the chance of survival to age 90 or beyond is common. At least one member of the couple has a greater than 50% chance of survival to age 92.8

Optimization software can compare strategy results simply by re-running selected strategies under various death-age scenarios to determine what age a survivor would need to live to in order for a strategy to make sense. In the Break-even chart below, we test the two strategies against each other varying the death ages of each member of the couple. The color of the dot at the intersection of two ages represents the strategy that would generate a higher present value of benefits at that combination. Dark Blue is the Suggested Strategy and Gray is the Early Strategy. This process is often visually impactful. When a client can see that in the vast majority of death-age possibilities, a Suggested Strategy will net them more benefits, they can be comfortable with the risk of coming up short if both encounter an early death.

The Break-Even conversation can be helpful, particularly to gauge a client’s willingness to implement a Social Security claiming strategy, but it cannot be the end of the discussion. It is time to bring the claiming strategy into the overall retirement income plan, considering the strategy’s impact on the client’s investments, taxes and risk management.

Comprehensive Retirement Income and Tax Considerations

For advisors who have made Social Security planning a significant part of their practice, Social Security optimization fulfills a critical role. It informs the investment and harvest of a client’s other assets. As such, the next step in the Social Security planning process is to bring the results of an optimization into a client’s overall financial plan. Key points of focus in the context of the plan are remaining portfolio value and annual net spendable income.

The Couple

John and Jane retired at the end of last year. In order to live the lifestyle they want in retirement, they will need $80,000 in after-tax retirement income. We will assume they need a 3% annual increase for inflation and they will achieve a 6% annual return on their IRAs.9 John’s IRA balance is currently $500,000 and Jane’s is $300,000. We assume 2015 tax brackets10, personal exemptions and standard deductions for over age 65, projected forward by 3% annually.

Because this process begins with a desired lifestyle goal, we will assume that the client withdraws enough from the portfolio annually to meet the $80,000 target, adjusted for inflation and after taxes are paid. If the portfolio cannot be sustained through life expectancy, then we consider what percentage of income could be sustained with Social Security alone. In this case, as in many, optimized strategies tend to result in both greater portfolio longevity and also a higher percentage of lifetime income met in the event the portfolio cannot be sustained.

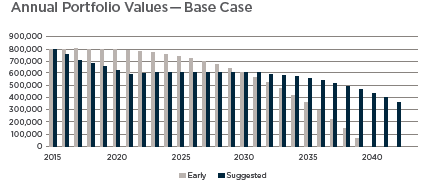

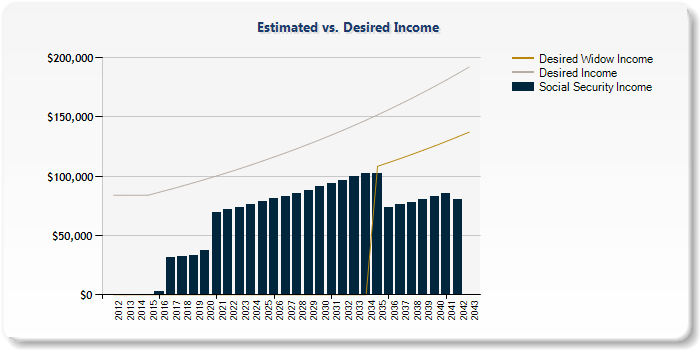

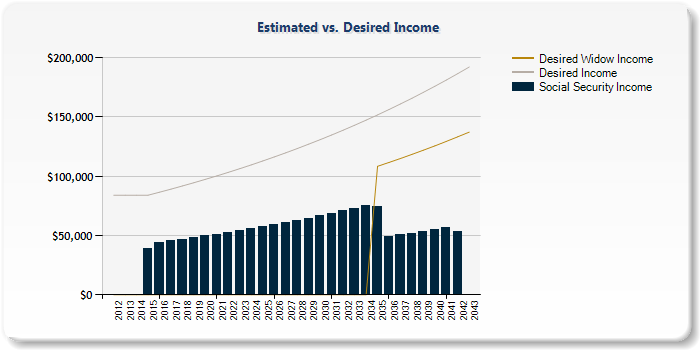

First, we’ll evaluate the base case John and Jane smoothly harvest from the portfolio to life expectancy with no unexpected events. The portfolio has been fully spent by 2039 in the Early Strategy, at which point approximately 44% of the income need would be met by Social Security.11 In the Suggested Strategy, the portfolio is able to meet the income need through life expectancy and has a remaining balance of over $355,000 at Jane’s age 90. If the portfolio were to be depleted under the Suggested Strategy, 66% of the client’s income need would be met by Social Security.12

Note the remaining portfolio value of $433,000 in 2040, after the portfolio for the Early Strategy has been exhausted. If we discount this amount to present, we come up with a value of just under $101,000. In our stand-alone analysis, recall that the value difference between the Early Claiming Strategy and the Suggested Strategy was $85,000. The additional $16,000 is indicative13 of value created due to tax reduction.

| Social Security Value-Add | Tax Value-Add | Total Strategy Value-Add |

| $85,000 | $16,000 | $101,000 |

Keep in mind, because these plan impacts are calculated as present value, executing this strategy is equivalent to adding $101,000 to the client’s portfolio immediately.

Tax Impacts Visible in the Plan

Prior to legislation passed in 1983, Social Security benefits were tax-free.14 For tax years beginning in 1984, up to 50% of Social Security benefits became taxable. If you were single and had “Provisional Income” over $25,000, or married with income over $32,000, 50 cents of each dollar of Social Security benefits over the threshold was treated as taxable income. In 1993, a second level of taxation was added, resulting in the taxability of up to 85% of Social Security benefits. For each dollar over $34,000 for singles and $44,000 for married couples, 85 cents of each Social Security dollar becomes taxable. In concept, the thresholds are relatively straightforward, but in practice, the formulas become complicated enough that the IRS created a separate worksheet to aid filers in calculating how much of the Social Security benefit is subject to tax.15 Consequently, clients and advisors often use rules of thumb, such as automatically treating 85 cents of every Social Security dollar as taxable. It’s not practical to do a 30-year retirement income analysis using the IRS worksheet, so again, many advisors use software to identify estimated taxes for different retirement income strategies.

In order to demonstrate the process by which the amount of benefits subject to tax is determined, we’ve broken the process into five steps and provided an example using our client couple’s household income in 2021, the first year that both members of the couple collect an entire year’s worth of retirement benefits in the Suggested Strategy. Perhaps surprisingly to most advisors, the Suggested Strategy would generate approximately $98,000 of income in 2021 and would face a Federal Tax bill of less than $2,500.

A few facts are necessary for the example:

- John’s Social Security Retirement Benefit in 2021: $47,268

- Jane’s Social Security Retirement Benefit in 2021: $22,344

- IRA Withdrawals in 2021: $28,311

Now, we use those facts in the five-step process to determine taxable benefits:

Step 1: Calculate Provisional Income “Provisional Income” includes half of Social Security benefits, plus all other taxable income including dividends, realized interest, and realized capital gains, plus nontaxable interest earnings, such as from municipal bonds. Notice that only half of the Social Security benefit goes into the calculation at this point. John and Jane’s total Social Security income is $69,612 for 2021, thus half is $34,806. Add the IRA withdrawals to get Provisional Income of $63,117.

| Step 1 — Provisional Income | |||

| Half of Social Security benefits | $34,806 | ||

| IRA Withdrawals | + | $28,311 | |

| Provisional Income | = | $63,117 | |

Step 2: Apply the First Threshold The first threshold for married couples, over which 50 cents of each benefit dollar becomes taxable is $32,000. Subtract $32,000 from the Provisional income calculated above, and then multiply by 0.5 because only 50 cents of each dollar above this threshold becomes taxable.

| Step 2 — First Threshold | |||

| Provisional Income | $63,117 | ||

| First Threshold | – | $32,000 | |

| Overage | = | $31,117 | |

| Multiply by 0.5 | x | 0.5 | |

| Taxable Benefit, First Threshold | = | $15,559 | |

Step 3: Apply the Second Threshold

Repeat the Step 2 process for the Second threshold. This time, we’ll multiply the overage by .35 because we’ve already accounted for the first 50 cents of taxability with our Step 2 Calculation.

| Step 3 — Apply Second Threshold | |||

| Provisional Income | $63,117 | ||

| Second Threshold | – | $44,000 | |

| Overage | = | $19,042 | |

| Multiply by 0.35 | x | 0.35 | |

| Additional Taxable Benefit | = | $6,691 | |

Step 4: Calculate Tentative Taxable Benefits Add the taxable benefits from Steps 2 and 3. In this case, the total is $22,249.

Step 5: Calculate and Apply the Maximum The highest possible taxable amount is 85% of the total Social Security benefit, or $59,170 in this case. Because Step 4 is less, the amount in Step 4 is the total taxable Social Security benefit for John and Jane.

In spite of the fact that these clients have almost $98,000 of income coming into their household, only $22,249, or 32% of their Social Security benefits, will be taxable on their Federal tax return.

When that amount is brought into the tax return to calculate the client’s total tax bill, we see an even larger impact. Assuming a standard deduction and personal exemptions totaling $27,224, a 10% bracket that extends to $22,030 and a 15% bracket that extends to $89,435 for 2021,16 John and Jane’s total Federal Tax bill on almost $98,000 of income would be $2,399.

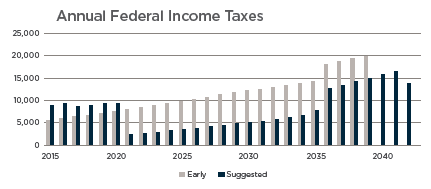

When we complete the same analysis for the Early Strategy for the year 2021, we see $35,058 of taxable Social Security and a total tax bill of $8,001, over three times higher than our Suggested Strategy.

| Calculations in 2021 | Early Strategy | Suggested Strategy |

| Social Security Income | $50,676 | $69,612 |

| Taxable Social Security | $35,059 | $22,249 |

| IRA Withdrawal | $52,849 | $28,311 |

| Tax | $8,001 | $2,399 |

| Spendable Income | $95,524 | $95,524 |

Tax Summary

Social Security benefits carry a substantial tax advantage over other forms of income, particularly IRA withdrawals, so delaying benefits in order to build a larger Social Security benefit often has a significantly positive impact.

In the example above, we focused on only one year, while an overall analysis shows the tax advantage persisting for the clients’ lifetimes. This strategy requires a relatively small negative impact in the short-term to realize a long-term positive impact. While a significant tax advantage may be realized over the long-term, it is important not to ignore the short-term expense. If IRA assets must be spent early in retirement to facilitate the execution of the Social Security Strategy, taxes will almost always be higher in the short-term. Be wary of sales approaches that suggest trading in taxable income for tax-advantaged income without showing the negative impact in the early years.17

Risk Management

When we look at the Social Security Strategy in the context of the plan, our first consideration is how long the portfolio lasts under the base case. If an optimized Social Security Strategy depletes the portfolio before the planned Social Security election date, it is a non-starter. If, on the other hand, it facilitates additional portfolio longevity through increased Social Security benefits and reduced taxes, then the plan should be tested to see how it performs under several measures of stress. Many firms have specific processes through which retirement income plans are stress tested, whether it be Monte-Carlo simulation or a variety of “what-if” scenarios. In this final section, we’ll stress test our overall plan with a focus on three core retirement risks; Sequence of Returns risk (a bear market immediately upon retirement), the early death of either member of the couple, and high health care expenses for either member of the couple late in retirement.

Sequence of Returns Risk

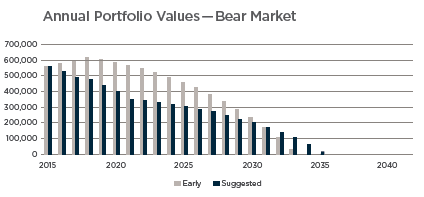

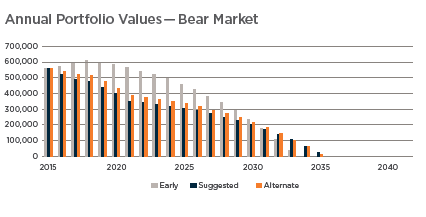

One of the most interesting stress tests to perform on a Social Security Strategy is to see how it performs under a bear market that occurs at the worst time possible for a retiring client, immediately at the beginning of retirement. For this test, we assume the portfolio loses 30% of its value immediately prior to the development of the plan. In other words, our clients who previously had $800,000 of investment assets now have only $560,000. To account for the potentially higher rates of return available for investments immediately following a bear market, we have increased the rate of return on the client IRAs from 6% to 12% for the first 3 years, then back to 6% thereafter, while maintaining the inflation rate at 3%. This scenario roughly represents an average bear market decline and recovery for an all equity portfolio.18 It also may be demonstrative of a major bear market for the more balanced portfolios that near-retirement clients tend to hold. Because each client would be invested differently, stress tests performed in individual cases should be representative of the potential declines the clients’ specific portfolios would be likely to encounter. This stress test should make the Early Strategy more appealing as less drawdown of the IRA accounts would be necessary to meet the overall income need.

When we view the results of this stress test on our particular client couple, we find that the advantage of the Suggested Strategy is not nearly as powerful, but it is present nonetheless as the portfolio lasts two additional years using the Suggested Strategy over the claim Early Strategy. Keep in mind, the client who followed the Suggested Strategy would have 66% of their income need covered by Social Security alone in the event of portfolio depletion, while the client who followed the Early Strategy would have only 43% covered by Social Security. The reality is that clients who encounter a sequence of returns like this would more than likely change their income goal before completely collapsing the portfolio.

There are several planning opportunities to mitigate the risk of a Bear market in early retirement on a delay strategy. Many advisors plan in advance by segregating specific short-term assets to be spent during the period of delay. Because of the additional value created by the Social Security Strategy, it may be possible to accept considerably lower yield on the assets to be spent early in retirement in order to bridge the gap until Social Security begins without forfeiting the entirety of the strategy advantage.

A different planning opportunity should be considered by advisors who primarily rely on a systematic withdrawal approach to harvesting retirement income. This method is merely a change of perspective. Rather than positioning the decision as only two options, claim early or delay to 70, these advisors position the Suggested Strategy as a target, but remind the client that they have an option each year to “bail out” of the Suggested Social Security Strategy and claim at that point if the market turns down and the client needs the ability to recover from the decline. This “bail-out” option is not one to take lightly, but it is an option nonetheless.

For example, if we re-run the prior analysis, but compare only the Earliest Strategy with one in which benefits are delayed by one year, then one additional year, the client can take an incremental approach which may be easier to commit to. For this example, we’ve incremented each client’s age by one until the Suggested claim age is reached. There is no incremental year in which the client “loses” in terms of lifetime Social Security value by delaying one additional year.

A third risk management approach would be to modify the claiming strategy of only the lower earner. In this case, we would have Jane claim immediately to partially reduce the impact of the bear market on the plan, but preserve the ability to build John’s Retirement benefit and the eventual Survivor benefit payable to Jane. If Jane were to claim as early as possible, but John were to delay his benefit until 70, filing for only a spousal benefit at 66, the lifetime value is $851,479. Although this strategy would extend the portfolio over the Early Strategy, it would not outperform the Suggested Strategy.

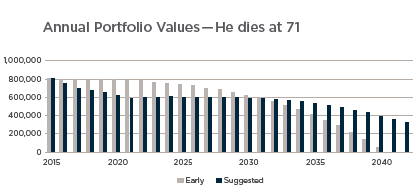

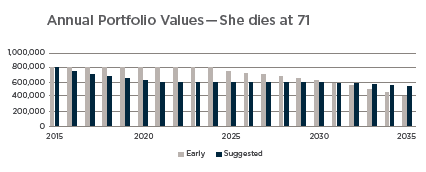

Mortality Risk — Early Death

For this stress test, we model death at 71 for each member of the couple. At age 71, there are no possible modifications to the Social Security strategies because in both our Early and Suggested Strategies, both members of the couple will have already claimed Social Security benefits. In the event we modeled a situation where the survivor had not yet claimed Social Security benefits, there would be additional “Widow” planning strategies that could add additional value, but would not be reflected in the analysis. We also assume that the survivor will need 75% of the income the couple needed when both were alive and we use Single tax brackets and standard deduction for over age 65 (this is a specific addition to the standard deduction) to account for the change in tax status

| Earliest | Suggested | ||||||||||||

| Strategy | 62/64 | 63/65 | 64/66 | 64/67 | 64/68 | 64/69 | 64/70 | ||||||

| Lifetime Value | $769,198 | $779,216 | $790,534 | $812,255 | $830,137 | $844,263 | $854,835 | ||||||

| Value Increase | 1.3% | 1.4% | 2.75% | 2.2% | 1.7% | 1.25% | |||||||

In the scenario where John dies early, we see very little difference from the results of our base case. A significant advantage for the Suggested Strategy persists.

When Jane dies at age 71, we see a similar picture, with the Suggested Strategy showing advantage at his life expectancy, but not significantly so. In this case, we see that he has plenty of portfolio value remaining under either strategy to significantly exceed his life expectancy.

Health Risk

In our final stress tests, we model extended care expenses late in life. To estimate the potential costs of an extended care situation, we used Nationwide’s Health Care Cost Assessment.

We’ve assumed that the final four years of life would be spent with home health care services with a projected cost of $43,700 for Jane, beginning at age 86 and inflating annually by 2%.

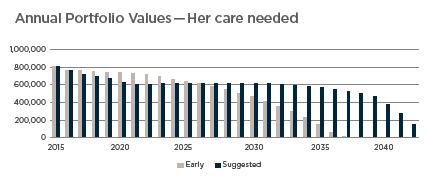

As you can see from the projected portfolio balance, the Suggested Strategy allows portfolio assets to be preserved such that the additional care expenses can be met without exhausting the portfolio. Further, if the portfolio were to be depleted, she still has a 50% higher income available from Social Security than under the Early Strategy that could be used to help pay for care.

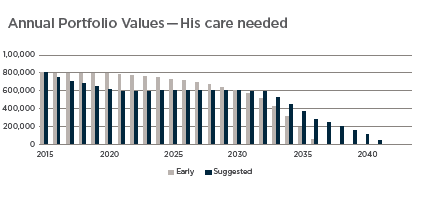

In our final stress test, we’ve assumed that John, rather than Jane has the care need, beginning at his age 81 and lasting four years, with an additional annual expense of $38,044 increasing by 2% per year. The chart below should throw a red flag for any advisor completing an analysis. We see the care need accelerating the depletion of the portfolio very quickly under the Early Strategy. Although the Suggested Strategy is able to maintain a portfolio balance through Jane’s age 89 in spite of the care need, we see a significant decline beginning with the additional care expenses for John. This is a situation in which some measure of long-term care planning should be addressed.

Summary

For the specific fact-pattern identified here, it is clear that following the Suggested Social Security Strategy would improve John and Jane’s situation. The strategy delivers the following benefits:

- $85,000 of additional projected Social Security Value

- At least $16,000 of Tax Savings

- Substantially Improved Risk Management

- Improved Portfolio Longevity even through a Bear Market

- Improved Survivor Income and Estate value even with an early death

- Improved ability to fund health care expenses late in life

Not every Social Security Strategy will display similar characteristics, but a process similar to the one outlined here should give advisors the ability to identify and quantify Social Security strategies and demonstrate the unique value they bring to the table.

Confidently guide Social Security conversations with your clients.

For more information and support, call the Nationwide Income Planning Team at 1-877-245-0763.

1. Shoven and Slavov “Does it pay to delay Social Security?” Journal of Pension Economics and Finance Vol. 13, Issue 02 April 2014, pp 121-144.

2. Munnell, Alicia “What is the average retirement age?” Center for Retirement Research at Boston College. August 2011.

3. Nationwide Health Care Cost Assessment—January 14, 2015.

4. Knoll, Melissa and Olsen, Anya. “Incentivizing Delayed Claiming of Social Security Retirement Benefits Before Reaching the Full Retirement Age.” Social Security Bulletin. Vol. 74, No. 4, 2014.

5. David Blanchett “When to Claim Social Security Benefits.” Journal of Personal Finance, Vol. 11, No. 2: 36-87.

6. Assuming 3% annual Cost of Living Adjustments

7. 1 month increment due to current age of the client couple, as there is no option for retroactivity for claims prior to Full Retirement Age.

8. Source: 2012 LIMRA Retirement Income Reference Book.

9. A 6% nominal rate of return with 3% inflation is entered into the Social Security Analyzer 360 as a 3% Real Rate.

10. http://www.irs.gov/publications/p17/ch20.html

11. Social Security Benefit of $54,744. Income need of $125,627 in 2040.

12. Social Security Benefit of $82,860. Income need of $125,627 in 2040.

13. The Net Present Value difference of taxes actually paid is $27,571. The observation above does not account for the additional years of higher social security income under the Suggested Strategy.

14. http://www.ssa.gov/history/taxationofbenefits.html

15. http://apps.irs.gov/app/vita/content/globalmedia/social_security_benefits_worksheet_1040i.pdf

16. Future values of current brackets and exemptions assuming 3% annual increase for 6 years.

17. Taxes for the Early Strategy end prior to the end of the analysis because the portfolio is exhausted, at which point the Social Security income comes through tax-free.

18 http://www.marketwatch.com/story/how-to-prepare-for-the-next-bear-market-2014-03-07

This is being provided for informational purposes only and should not be construed as investment, tax, or legal advice or a solicitation to buy or sell any specific securities product. The information provided is based on current laws, which are subject to change at any time, and has not been endorsed by any government agency.

Federal income tax laws are complex and subject to change. The information in this white paper is based on current interpretations of the law and is not guaranteed. Neither the company nor its agents representatives gives legal or tax advice. You should consult your attorney or tax adviser for answers to your specific tax questions.

Nationwide Investment Services Corporation (NISC), member FINRA. Nationwide Retirement Institute is a division of NISC. Nationwide and Social Security Timing are separate and non-affiliated companies.

Social Security 360 Analyzer is a service mark of Nationwide Life Insurance Company. Nationwide, the Nationwide N and Eagle, Nationwide is on your side and Nationwide Retirement Institute are service marks of Nationwide Mutual Insurance Company. © 2015 Nationwide

NFM-13746AO.1 (02/15)

Appendix – Your Suggested Social Security Strategy

John

- File a Restricted application for only your spousal benefit based on Jane’s earnings record at your age 66 years. This allows you to continue to earn delayed retirement credits on your own benefit. Your approximate spousal benefit would be $926

- File for your own benefit at age 70 years. Your approximate benefit on your own earnings record would be $3,824.

Jane

- File a standard application for benefits at age 64 years. Your approximate monthly benefit would be $1,606.

The expected lifetime family benefit using this strategy is: $854,835

Using the Suggested Election Ages

The preceding charts demonstrate future value cashflows using the assumptions outlined on the assumptions page of this report, and do not include taxes or any other source of income. The desired income line is generated based on user input and inflated for future value using the same inflation assumptions.

Appendix – Your Earliest Possible Social Security Strategy

John

- File a standard application for benefits at your age 64 years 1 month. Your approximate benefit would be $2,194

Jane

- File a standard application for benefits at your age 62 years 1 month. Your approximate benefit would be $1,364

The expected lifetime family benefit using this strategy is: $769,198

Using the Earliest Possible Election Ages

The preceding charts demonstrate future value cashflows using the assumptions outlined on the assumptions page of this report, and do not include taxes or any other source of income. The desired income line is generated based on user input and inflated for future value using the same inflation assumptions.

Download Attachments: Download the Whitepaper